Hungary was much better prepared for coronavirus than 2008 financial crisis, study shows

The irresponsible economic policies of the Socialist governments have made the Hungarian economy vulnerable in terms of every key indicator ahead of the 2008 crisis. In contrast, Hungary was in a stable and crisis-resistant mode when hit by the coronavirus pandemic in 2020, thanks to the successful economic policy measures introduced in previous years, according to a study presented by the Oeconomus Economic Research Foundation in Budapest on Wednesday.

„In crisis situations the success of tackling a problem is typically determined in the preparation phase. The economic crises have had the most adverse effect on those countries that have been on an unsustainable path for quite a while,” said Geza Sebestyen, a senior research fellow at the Oeconomus Economic Research Foundation, presenting a study titled „Crisis management begins with preparations” (A válságkezelés a felkészüléssel kezdődik) to the press in Budapest on Wednesday.

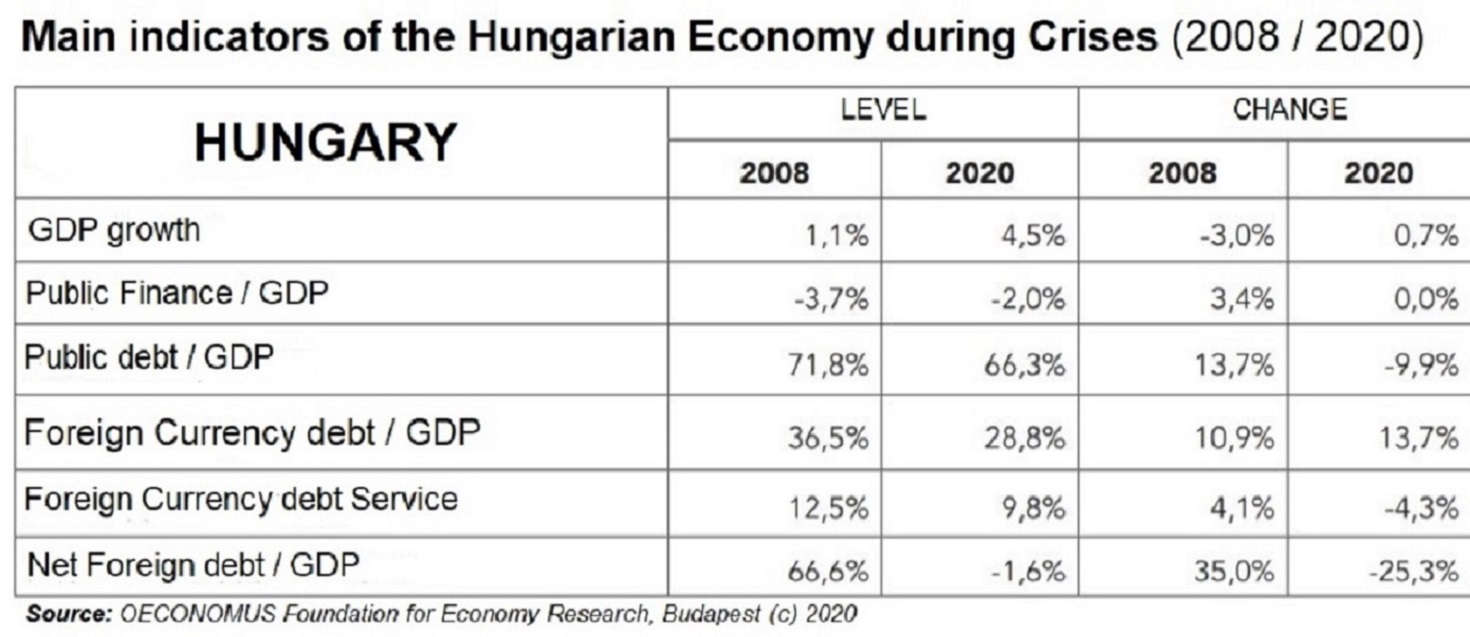

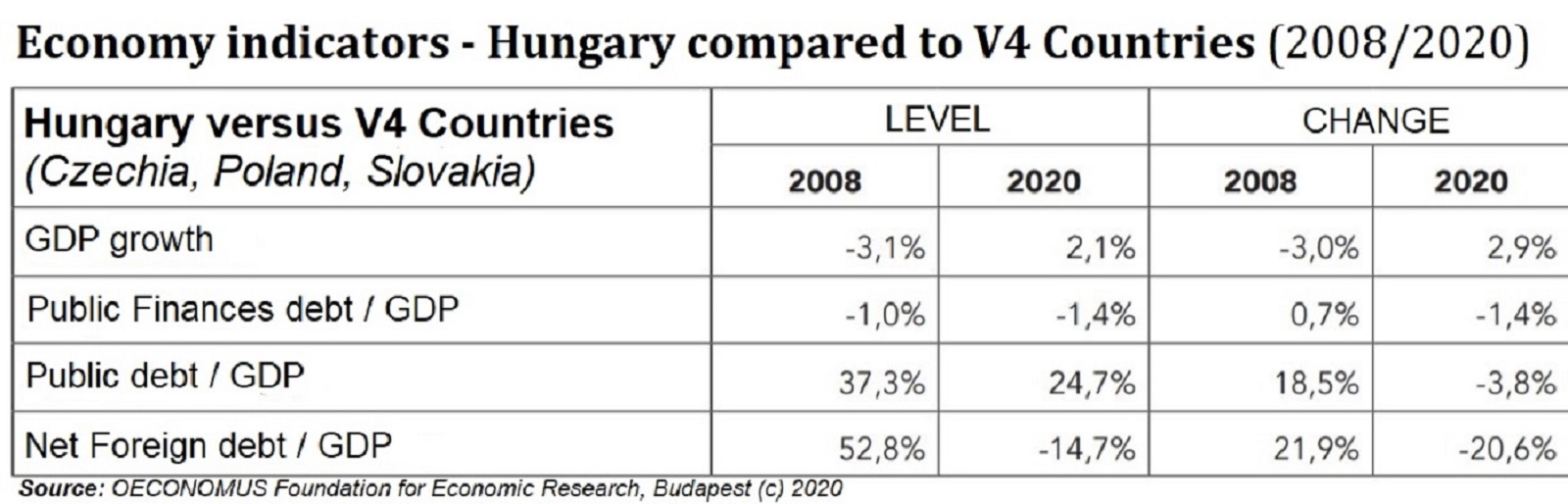

The researchers examined the two biggest global crises of recent decades: the 2008 subprime mortgage crisis originating from the US and the global economic crisis caused by the coronavirus pandemic in the spring of 2020, in terms of their impact on the economic indicators of Hungary and the other Visegrad Four countries (Poland, the Czech Republic and Slovakia). The analysis considers five important macroeconomic aspects – proportionate GDP growth, general budget deficit, government debt, as well as the level of foreign currency loans and net external debt – in comparing Hungary s and Central Europe s sitation in 2008 (and before), with the year 2020.

Based on the economic indicators, the study highlights that Hungary was quite vulnerable ahead of the 2008 crisis as a result of the irresponsible economic policies of the Socialist governments in power at the time. During the term of former Prime Minister Ferenc Gyurcsany, the country had low and declining economic growth, an extremely high general government deficit, steep public debt, rising foreign currency debt ratios and a markedly high and rapidly deteriorating net foreign debt stock, making the country critically exposed to the credit crunch. With abismal growth rates, the state – just like the businesses and the private individuals – had no adequate savings, while soaring deficit and public debt figures have left Hungary little room for maneuver. Hungary s unfavourable economic indicators have made financing the country, already locked in a vulnerable position, rather difficult, as the charts clearly show.

The @EU_Commission predicts that the #EU economy will shrink by 7.4% this year, the gravest #recession on record. The #Euro area is to fare even worse in 2020 at -7.7%. Recessions of V4 countries are projected to be softer.

️ Read more: https://t.co/MRX0cQ4vmx pic.twitter.com/Dul13qctNd

— GLOBSEC (@GLOBSEC) May 12, 2020

In contrast, since the centre-right Fidesz government was elected in 2010 – and then re-elected by a large margin in both 2014 and 2018 – the Hungarian economy is characterised by distinctly positive and improving indicators: the general government deficit is low and stable, public debt is rapidly improving, the country s foreign currency debt indicator has performed well and the net foreign debt indicator has dropped to a minimum. „Thanks to successful economic policy measures, the 2020 coronavirus crisis found Hungary in a stable and crisis-resistant mode,” the analysis concludes.

Compared against the other V4 states, Hungary s growth in 2008 was significantly, 3.1 percentage points lower than the regional value. The country accumulated a 3.0 percentage point growth deficit compared to the neighbouring countries in just a few years. Hungary s general government debt was 1.0 percentage point higher while the country s public debt was 37.3 percentage points higher, with the latter showing a rapidly deteriorating tendency.

In contrast, at the end of 2019 Hungary s economy could be described as producing excellent growth and good debt indicators. Growth surplus was significant at 2.1 percentage points compared to other countries in the region. This indicator improved by 2.9 percentage points between 2015 and 2019. General government debt sank to 1.4 percentage points below the regional value at the end of 2019, with the indicator exhibiting an identical (1.4 percentage points) dip. Although Hungary s public debt was worse than the regional value despite an improvement of 3.8 percentage points, it is more significant in a crisis situation that – following an improvement of 20.6 percentage points – Hungary s net foreign debt indicator was 14.7 percentage points better than that of the other V4 states, the study compiled by the Oeconomus Foundation for Economic Research concludes.