Beware Britain, here comes short-selling Soros

Monday s news reports claiming that PM Boris Johnson was admitted to hospital with persistent coronavirus symptoms had serious economic ramifications as the pound sterling moved lower in response. Because of the current economic uncertainties and volatile currency markets an increasing number of countries may become the target of stock exchange speculators like George Soros. Matteo Salvini warned about the risks of short-sellling transactions a month ago, but the danger hasn t passed.

Although British Prime Minister Boris Johnson announced a few days ago on his Facebook page that he was feeling better, he had to be admitted to hospital on Sunday.

The initial news reports claimed that the politician required mechanical ventilation, but it later turned out that this type of respiratory support was unnecessary and Mr Johnson was only given oxygen before he was taken to intensive care.

The UK government is currently headed by Foreign Secretary Dominic Raab.

The pound sterling took a hit after the prime minister was hospitalised. Although the exchange rate stabilised overnight, experts agree that the currency will remain sensitive to future announcements.

According to forecasts published by the international credit ratings agency S&P Global, Britain s economy protection measures through novel coronavirus will push the country s debt-to-GDP ratio over 90% this year. The projections, it said, were based on the assumption that economic activity will resume in the second half of the year, as well as on a 1.9% real GDP contraction for the year as a whole.

The economic difficulties and exchange rate fluctuations caused by the coronavirus pandemic can make the currency a perfect target for market speculators, especially George Soros, who made his fortune by short-selling transactions. The UK would do well to keep an eye on the manoeuvres of the stock market speculator, as he has already succeeded in breaking the British pound.

16 September 1992, the day when George Soros caused the pound sterling to collapse, became known as Black Wednesday. The speculative operation, which earned the billionaire worldwide notoriety, cost British taxpayers some 30 billion euros, while Soros made some 900 million euros on the move. Following the action, the Bank of England was unable to maintain the pound s exchange rate and the UK was forced out of the ERM system.

Ahead of Black Wednesday, Soros and his investment fund began building up a huge short position against the pound sterling, effectively speculating on the fall of the exchange rate. Meanwhile, the British government started using its foreign currency reserves to keep the exchange rate at an appropriate level by buying pound sterling, but even that proved insuffucient to prop up the currency and stop its fall.

And this is precisely what Soros had been waiting for. On 15 September, Soros and his fund began selling large amounts of sterling. The Bank of England intervened and started buying pound at the beginning of the trading day, on 16 September, but they were unable to shore up the sterling and keep up with the speculator s fund. By the morning of Black Wednesday, Soros sold 10 billion dollars worth of pound sterling.

John Major, already prime minister by then, finally accepted that they were unable to stop the fall by pound purchases and decided on increasing the base rate from 10 to 12 per cent. However, this only proved to serve Soros s interests. The market saw this as a sign of weakness and continued selling the pound.

George Soros is clearly a businessman, no matter how hard tries to sell himself as a philanthropist. In 2018, Financial Times chose the billionaire as its Person of the Year, noting that he has his own foreign policy.

Talking to 60 Minutes on the American CBS television network, he admits that he is only interested in money.

„I am basically there to make money. I cannot and do not deal with the social consequences,” Soros said.

In the same interview, he reveals that his character „was made” at the age of 14 as he watched the Nazis shipping off Jews to the death camps from Budapest. He also admits that he helped in confiscating their property.

It wasn t difficult, „not at all. Maybe as a child, you don t see the connection, but it created no problem at all. Of course, I could be on the other side… but there was no sense that I shouldn t be there… If I weren t there, because I wasn t doing it, somebody else would be taking it away anyhow… I had no role in taking away their property, so I had no sense of guilt,” Soros said.

Moreover, Soros is generally proud of his work.

Many have drawn attention to the activities of the speculator, including Italy s former Interior Minister Matteo Salvini.

In early March, stock indexes across the globe plummeted to unprecedented levels. Stock markets began panicking on 9 March, with Tokyo witnessing a 5% drop in stock prices and South Korea and Hong Kong sliding down 4.5 per cent. The downward trend continued in Europe. London s FTSE closed at 5965.77 points (-7.69%), Paris s CAC-40 index at 4707.91 points (-8.39%), while Frankfurt s Dax at 10625.02 points (-7.94%). The Madrid Stock Exchange experienced a 7.52% drop and the Milan Stock Exchange – hit the hardest by coronavirus – lost 9.98%. Back then, the underlying reason was not the coronavirus pandemic but the 30% plunge in crude oil prices induced by Saudi Arabia, which launched a price war against Russia on Monday.

A day before the stock market panic, on 8 March, Matteo Salvini appealed to the authorities on his Twitter page. The politician called for a ban the purchase of securities from so-called short selling transactions.

„In situations like these, very few people can sometimes earn huge amounts. We remember, for example, the case of Soros in 1992, who built his fortune with a downward speculation against Italy,” Salvini wrote.

In situazioni come queste a volte in pochissimi guadagnano cifre enormi a danno di tutti, ci ricordiamo ad esempio il caso di Soros nel 1992 che costruì la sua fortuna con una speculazione al ribasso contro l Italia. (2/3)

— Matteo Salvini (@matteosalvinimi) March 8, 2020

Salvini s warning wasn t unfounded, as Soros initiated speculative moves against the Italian lira around the same time when speculators broke the British pound. According to news reports at the time, the lira lost 30% of its value as a result of the speculation, while Italy s National Bank used up 48 billion dollars to defend it, in vain. Former Italian Prime Minister Bettino Craxi said it was uncler how much Soros had made on the transaction.

Years later, EIR Economics reported that Italians had launched an investigation against George Soros in Rome and Naples on 16 February, 1996, and the Italian press branded Soros the „killer of the lira”, according to the newspaper.

However, the US stock market speculator has also wreaked havoc in other countries.

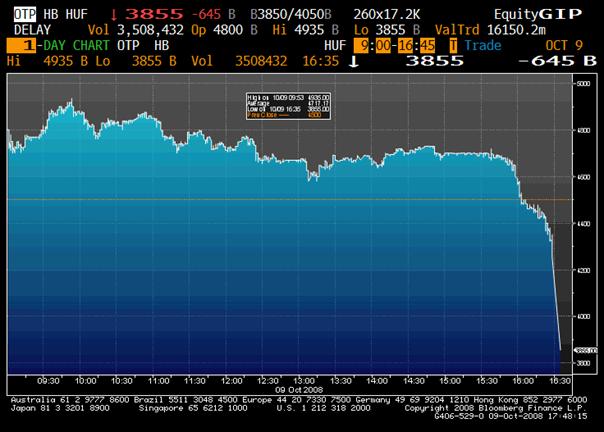

On 9 October, 2008, George Soros launched an attack against Hungary s largest commercial bank, OTP. As a result of Soros s short-selling, the index of the Budapest Stock Exchange (BUX) dropped 7.1 per cent, the Hungarian forint took a nosedive and trading government securities drew to a near complete halt. The sudden plummeting of the BUX index came as a direct result of a dip in OTP share prices.

The Hungarian Financial Supervisory Authority (PSZAF) launched an investigation the next day. After months of inquiry, the market regulator revealed that the attack against OTP was carried out by the Soros Fund Management LLC owned by George Soros. After establishing that Soros and his firm broke the rules on influencing the market, PSZAF imposed a 489-million-forint fine (or 2.5 million dollars at the forint s exchange rate at the time). PSZAF estimated the earnings from the deal at 675,000 US dollars and set the fine at 4 times the profit.

In 2017, due to a system failure, the Netherland s financial authority (AFM), responsible for supervising the operation of the financial markets, published the list of speculative funds betting for a fall in stock prices back to 2012. The data disappeared soon, but George Soros s fund was also on the list, as it built up speculative positions against the Dutch ING Bank. As speculative funds prefer to conceal their short positions, they usually bet on a drop between 0.3 and 0.5 per cent, which they are not obliged to disclose. According to leaked data, Soros bet on a 0.3 percent drop in ING s share prices.

Immediately after the Brexit referendum, the Soros Fund Management took out a huge bet that Deutsche Bank shares would fall. Soros s investment fund had a short position of 0.51 percent, or about 7 million Deutsche Bank shares. The financial institution s shares dropped by 16% after the opening and eventually suffered a 14% loss. Soros invested 100 million euros in his short-selling transaction.

Of course, the economies of Europe will not simply stop. The finance ministers of the EU member states are to meet for a videoconference on Tuesday, to reach an agreement on the eurozone s €410 billion bailout fund.

The situation is rather complex, with deep divisions between the rich northern countries and the heavily indebted southern states. Ministers are expected to sideline a proposal to issue so-called coronabonds, which would pool borrowing among EU member states to fight the crisis.

A group of states including Italy, France and Spain have been urging Germany, the Netherlands and Austria, among others, to adopt common debt instruments to cushion the economic damage caused by the pandemic.

However, certain politicians rejected the plea, arguing that the initiative would lead to another sovereign debt crisis.

Germany assumed the position that the issuing of Eurobonds as an instrument to migitage the adverse economic effects of the coronavirus pandemic was not the right response, and the eurozone s permanent crisis management tool, the European Stability Mechanism (ESM), should be mobilised instead.

German finance ministry spokesman Dennis Kolberg said the ESM should remain in focus, because the permanent crisis resolution mechanism is the most expedient and efficient way to deliver aid to where it is most needed.

Austria s Finance Minister Gernot Blumel also argued for the deployment of the European Stability Mechanism, affirming that the Austrian government was opposed to the issuance of coronabonds.

Italian Prime Minister Giuseppe Conte is, however, a strong advocate for coronabonds. He went so far as to contend that if such a new instrument could not be developed, then, in his opinion, the legitimacy of the whole EU project would be called into question.

It is eerily apparent that George Soros and like-minded speculators do everything to accrue wealth. The screenplay is simple: media outlets financed by them blow certain issues out of proportion prompting the economies to react. And if that s not enough, their „civilian activists” also come into sight and – in cahoots with their loyal politicians – do everything they can to advance the speculators economic interests.