War spurs soaring oil market prices

Cheaper Russian crude brings significant profit gains for companies.

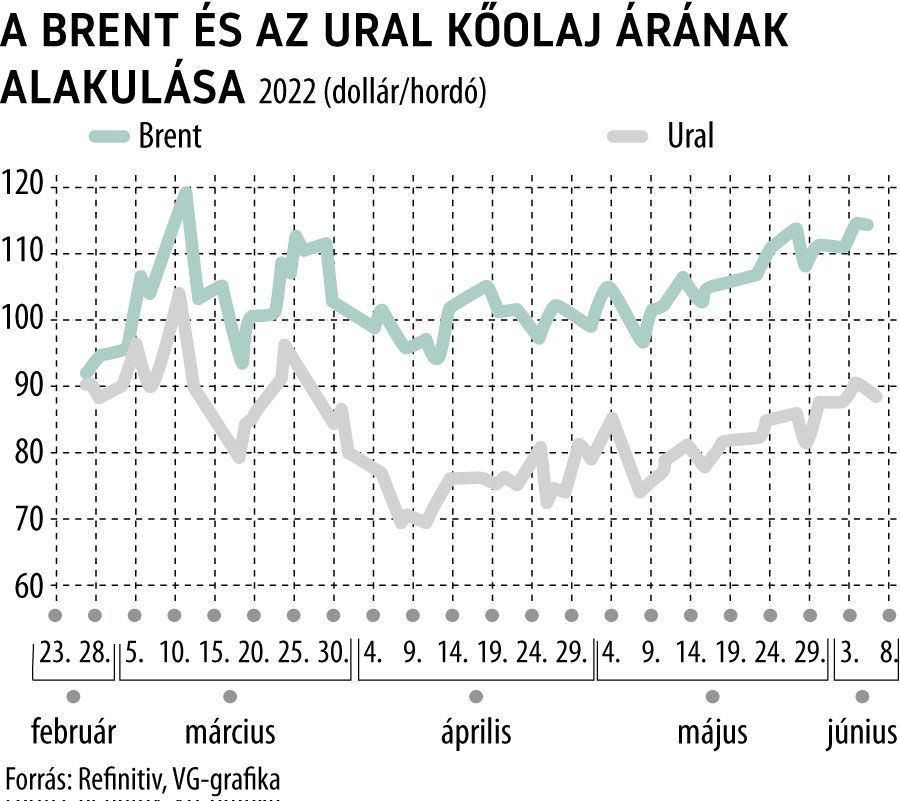

The outbreak of the Russia-Ukraine war have shaken the price of energy sources, including crude oil, but the listing of two major types of oil on the European market has taken opposing paths since the conflict, the Vilaggazdasag reports. The price of North Sea Brent crude has risen sharply in recent months, from $96.60 a barrel on the day before the outbreak of the war to $123.70 a barrel, according to the latest data as of 10 June. This means a hike of 30 per cent between the two dates, furthermore, the charts show an upward trend over the past month also.

In contrast, the price of Urals crude oil took the opposite direction: while on 23 February it was being sold at $95 a barrel, on 10 June it fell to only $89.30. This represents a 6 per cent price drop. While it is true in recent weeks that a rising trend has emerged here as well, it is much less pronounced as in the case of Brent, and a downward turn has been visible in the last 2-3 days.

The price differential of the two types of crude oil on the market has widened significantly, with Brent being barely $1.64 more expensive on 23 February, but by June 10, the price gap had widened to $34.40.

This is a nearly 21-fold increase, with the difference in price reaching a third of the price of Urals crude oil and a quarter of Brent’s. This has created an opportunity for some companies to gain extra profits, as some oil companies tie the prices of their refined petroleum products to Brent crude oil listings, even though they are in fact using the much cheaper Urals oil for their production. One such example is the Hungarian MOL Group, where primarily Russian Urals crude is used in its refineries. As a result of the Ural-Brent peacetime price differential of $5 per barrel surging to $30-35, MOL raked in significant extra revenues, according to the article.

Tags: